The Myrtle Beach real estate market continues to attract attention from investors and homeowners seeking both lifestyle and financial benefits. Known for its beautiful coastline, robust tourism economy, and long‑term appeal, Myrtle Beach offers opportunities that can grow wealth through property appreciation- especially when combined with well‑planned leverage strategies.

In this article, we’ll walk through the data‑backed appreciation trends in Myrtle Beach, explain how real estate leverage accelerates wealth creation, and outline realistic timelines for building equity.

Market Snapshot: Where Myrtle Beach Stands Today

Before diving into long‑term trends, it’s important to understand the current market context:

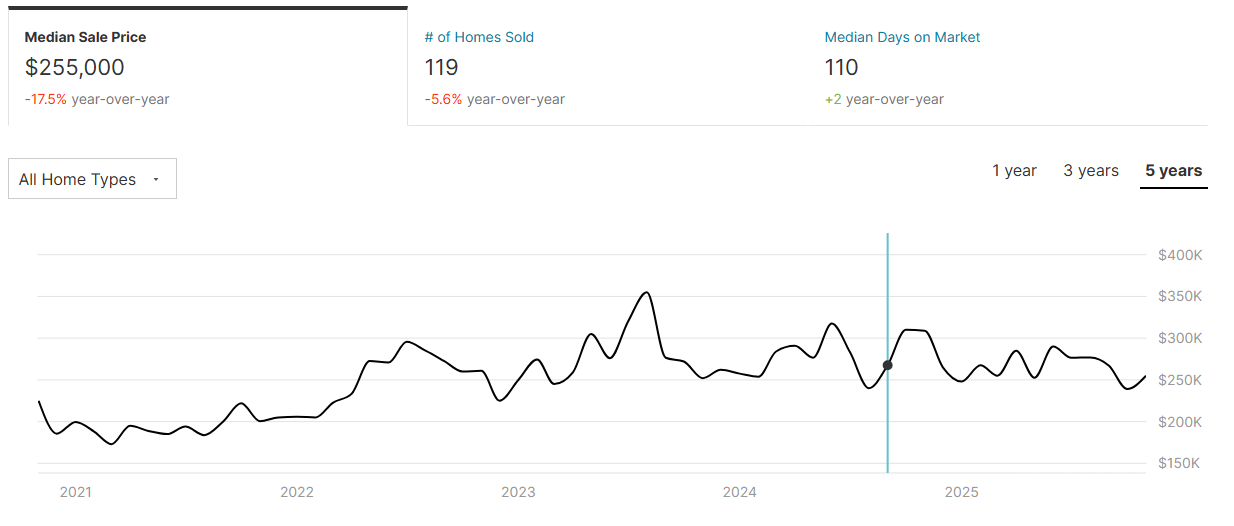

- According to Redfin, Myrtle Beach home prices have shown fluctuations in 2025, with median sale prices at around $267,000. However, looking back on the past 5 years there has been an increase of about 18.4% in home values. That equates to a nearly 4% appreciation per year. Redfin

- Realtor.com data shows median listing prices near $289.8K in mid‑2025, with median sold prices around $328K, illustrating differences between asking and realized values in various sub‑markets. Realtor

- Broader trend analyses suggest Myrtle Beach saw dynamic growth in the years following the pandemic, though cooling has taken place amid rising interest rates and changing demand patterns. Reventure News

Despite short‑term volatility that is being seen in most markets, many long‑term investors continue to view Myrtle Beach as fundamentally attractive, given its population growth, coastal desirability, and rental market strength.

Understanding Property Appreciation: Historical & Long‑Term Trends

Historical Appreciation in Myrtle Beach

Over the past decade, housing markets nationwide — including Myrtle Beach — experienced cumulative gains driven by demographic shifts and low interest rates during the post‑pandemic era. While exact five‑year averages fluctuate depending on the data source and timeframe:

- Local market data historically showed positive appreciation — including around an average of roughly 4% per year over multi‑year spans

- More people are moving to the Myrtle Beach area than anywhere else in the country, according to a report by Pods

- Homes and apartments are still being built to capitalize on that demand, but the demand doesn’t seem to be slowing down

These long‑term trend underscores the potential for properties to grow in value over time, even when annual year‑over‑year prices may temporarily soften.

Seasonal & Cyclical Market Behavior

Real estate markets like Myrtle Beach don’t move in a straight line. They go through cycles:

- Boom periods where demand outpaces supply and pushes prices upward.

- Cooler periods where prices stabilize or dip slightly due to higher interest rates or economic headwinds.

Even in cooling phases, well‑positioned properties often weather short‑term downturns and resume appreciation over longer horizons. If you can maintain a long-term mindset and goals, you’ll ultimately have investing success.

How Appreciation Builds Real Wealth

Owning real estate — especially rental property — can grow your net worth in multiple ways. Many new investors focus on cash flow, and while cash flow is an important metric, appreciation is the real wealth-driver in a real estate investment.

As a property increases in market value:

- Your equity (the difference between your mortgage balance and property value) grows without you needing to pay down your loan.

- Appreciation compounds over time — for example, a property bought at $300,000 appreciating at an average of 4% annually could be worth well over $400,000 in 10 years.

- Real Estate has been one of the steadiest asset classes in terms of consistent growth and Myrtle Beach has been one of the better performing cities over the last 40 years

Even moderate annual growth adds up significantly when held over multiple years.

Leveraging Debt: Increasing Returns with Smart Financing

One of the most powerful wealth‑building tools in real estate is leverage — using mortgage debt to control an asset larger than your available capital. In other words, you can earn on the full value of an asset without having to pay the full price.

Why Leverage Matters

Say you buy a $300,000 property with a 20% down payment ($60,000). If the property appreciates to $350,000:

- That’s a $50,000 gain on a $60,000 investment — an 83% return on your cash — even before rental income. This effect is known as return on equity amplification.

Debt Works for You When:

Mortgage rates are reasonable relative to appreciation expectations.

- Rental income nearly covers expenses (mortgage, taxes, maintenance).

- You hold the property long enough to ride out short‑term pricing fluctuations.

This is why many seasoned real estate investors lean into rental properties as long‑term wealth building vehicles.

Where Should I Be Buying?

Markets like Myrtle Beach are known as appreciation markets because they perform better in terms of appreciation than they do with cash flow. There are multiple reasons for this, but supply and demand is the number one reason:

- The beach is the most desirable location

- Typically, the closer to the beach you are, the more valuable your home is

- There is a limited supply of beach available

- As referenced earlier, there are a lot of people moving to the area for the beach and this demand is driving home values up

Now you may be asking yourself where I should be buying. There are a few communities that I would point out and these are communities in great locations with desirable homes:

- Dunes Club or Grande Dunes Community- this is known to be one of the most desirable areas along the beach and has some beautiful homes

- Barefoot Resort- you’ll find four of the best golf courses surrounded by great homes and condos

- Market Common- this community tracks older couples and families looking for great walkability

- Carolina Forest- this area is blossoming with great communities and you can learn more about in one of our blogs here

Positioning Beach Rental Group as Your Trusted Partner

At Beach Rental Group, we understand the nuances of the Myrtle Beach market and what it takes to maximize your investment:

- We help identify properties with strong appreciation and rental prospects.

- We can provide rental estimates for any property you’re interested in.

- We support investors with actionable insights backed by data.

Check out our Management Services page and try our free Rent Analysis tool. It will shoot an informative rental report in seconds after plugging in the rental’s address.

Conclusion: Turning Appreciation Into Opportunity

Myrtle Beach’s housing market offers a great opportunity for long‑term wealth building. While short‑term metrics may vary year to year, historical appreciation trends and strategic leverage make real estate a powerful tool for home value growth.

By combining sound investment strategies with expert local guidance from us at Beach Rental Group, you can position your property portfolio for both financial growth and lasting value in one of South Carolina’s most dynamic coastal markets.

.png)